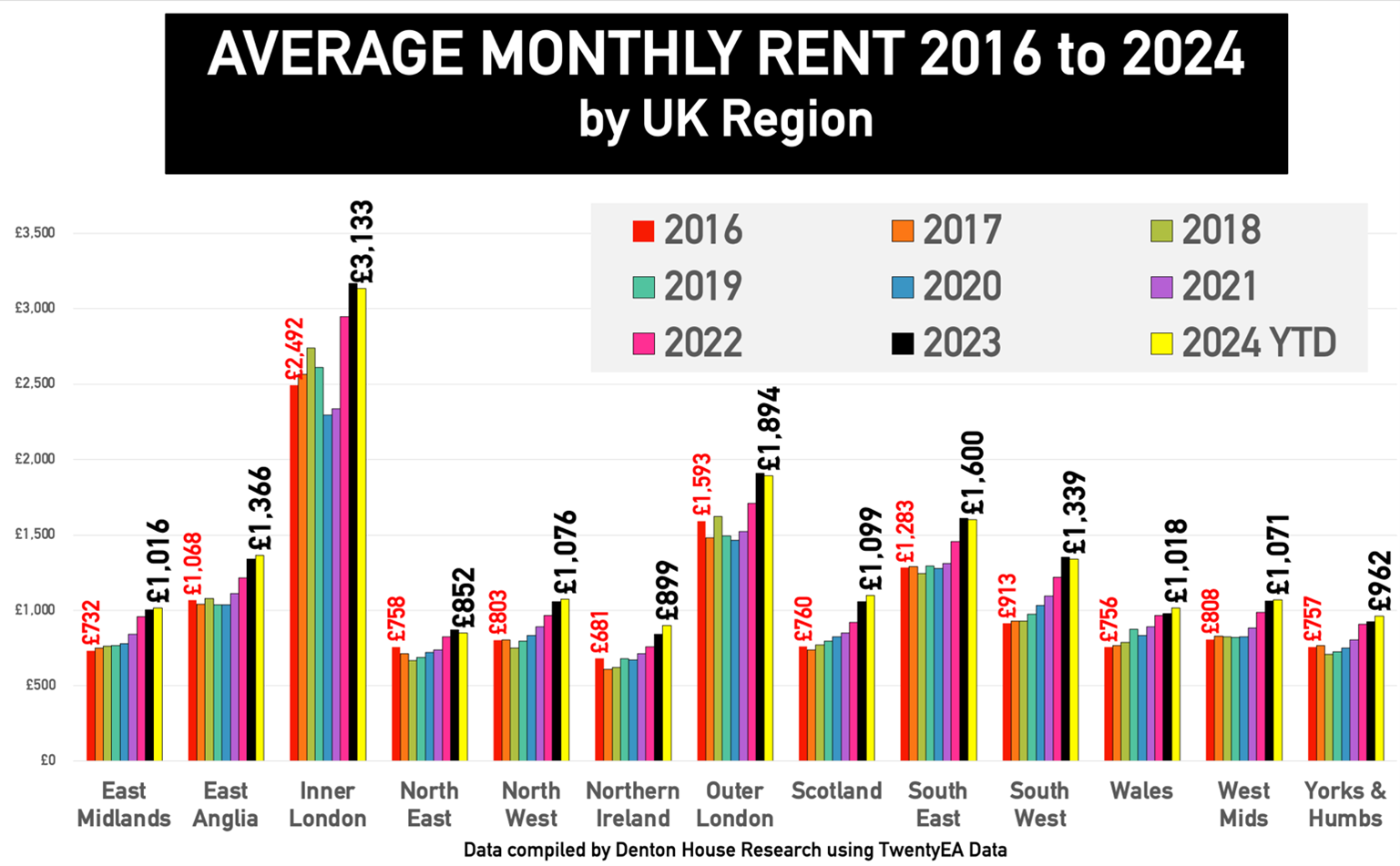

Over the past few years, the UK rental market has experienced significant fluctuations, with rents increasing dramatically during the Covid-19 pandemic. Between 2020 and 2022, demand far exceeded supply, driving rents to unprecedented levels. For instance, in the South West, the average rent rose from £913 per calendar month (PCM) to £1,339 PCM year-to-date in 2024.

However, the last 12 months have seen a slight increase in the number of properties available for rent, both nationally and regionally, leading to a more balanced market. This article will explore these trends and see if the same is happening in Crediton.

National and Regional Trends in Buy-to-Let

Nationally, the rental market has witnessed a notable shift in the last 12 months. During the pandemic, many factors contributed to the surge in rental prices, including the migration of people seeking more spacious living conditions and the disruption of new housing developments. As restrictions eased, the rental market gradually started to show signs of stabilisation. According to recent statistics, there has been a slight uptick in the supply of rental properties across the UK, which has helped temper the rapid rise in rents.

In April 2023, 87,592 UK rental properties came onto the market. This number increased by 14.86% to 100,614 in April 2024.

Regionally, the South West mirrors this national trend where 5,890 rental properties came onto the market in April 2023. This increased to 6,709 rental properties in April 2024, a rise of 13.9%.

In April 2023, the average rent achieved for a new UK rental property was £1,641 PCM. The average rent increased by 8% to £1,772 PCM in April 2024. This is a far cry from the national double-digit percentage increases in the mid to late teens only 12/18 months before.

The South West is ahead of this national trend in rent increases. The average rent for new properties that came onto the market in April 2023 was £1,166 PCM. This increased to £1,309 PCM for those that came onto the rental market in April 2024, a rise of 12.3%.

The increased availability of rental properties has brought some relief to tenants, who had been grappling with steep rent hikes of +20% per annum for some types of properties. Despite this increase in supply, the demand for rental properties remains robust, ensuring that rental yields continue to be attractive for landlords.

The Crediton Rental Market

In Crediton, the rental market followed a similar trajectory in the post-pandemic years of 2021/2, as rents surged due to a significant imbalance between supply and demand.

To see if this pattern has continued in Crediton, we have analysed the first four months of 2023 versus the first four months of 2024. This broader analysis provides a more reliable overview than focusing on a single month, given the small sample size for Crediton.

During the first four months of 2023, 60 rental properties came onto the market in the Crediton area (EX17) with an average rent of £871 PCM. In the first four months of 2024, 49 Crediton properties came onto the market for rent with an average rent of £983 PCM, a rise in rent of 12.9%.

Why Crediton Buy-to-Let Remains a Strong Investment

Despite recent market adjustments, Crediton remains a compelling investment opportunity for several reasons:

Strong Rental Demand: Crediton’s rental market continues to benefit from strong demand. The town's attractive location, good transport links, and quality of life make it a desirable place to live, ensuring a steady stream of potential tenants.

Affordable Property Prices: Compared to other regions, Crediton offers relatively affordable property prices. This affordability, combined with solid rental yields and long-term stable capital growth, makes it an appealing option for buy-to-let investors.

Economic Growth and Development: Crediton is experiencing economic growth, with ongoing developments in infrastructure and amenities. This growth not only enhances the quality of life for residents but also boosts the rental market by attracting more people to the area.

Long-Term Investment Potential: The recent stabilisation in the rental market suggests a move towards long-term sustainability. For landlords, this means the potential for consistent rental income and capital growth over time.

Addressing Crediton Tenant Concerns

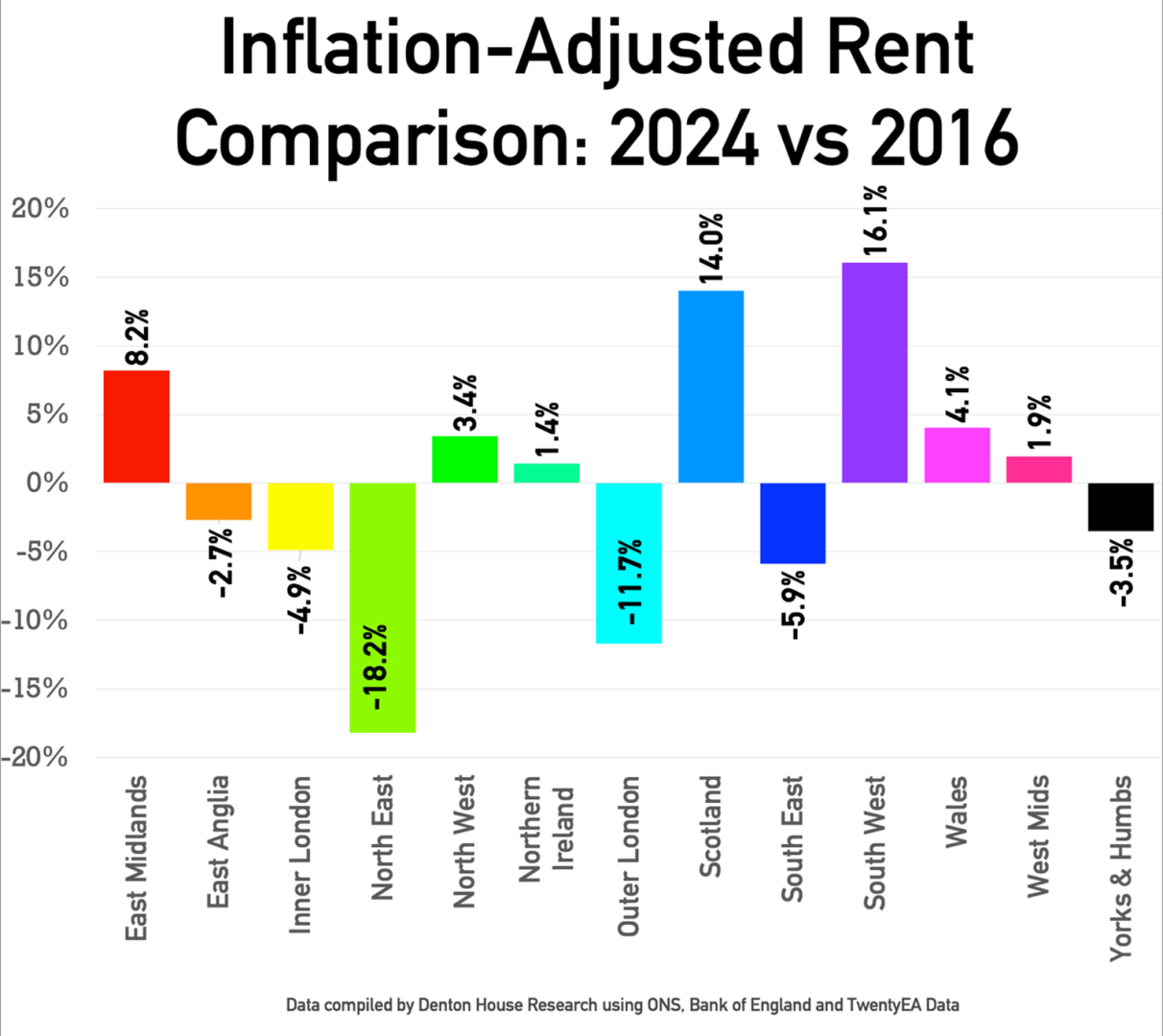

It's important to address the concerns of Crediton tenants who may feel burdened by recent rent increases. While rents have risen significantly, these increases have generally aligned with inflation rates over the medium term (since 2016). This means that, in real terms, the cost of renting has not increased disproportionately.

For tenants in Crediton, the slight increase in rental supply offers a glimmer of hope. A more balanced market could lead to more competitive rental prices and better opportunities to find suitable housing. Landlords should be mindful of maintaining good relationships with tenants, recognising the importance of fair and transparent rental practices.

The Future of Buy-to-Let in Crediton

Looking ahead, the Crediton buy-to-let market appears poised for continued stability and growth. Landlords should take advantage of the current market conditions to expand their portfolios. The combination of strong demand, affordable property prices, and the town’s economic prospects make Crediton a smart investment choice.

For those considering entering the buy-to-let market, now is an opportune time. The national and regional stabilisation of rental prices indicates a mature and sustainable market, reducing the risks associated with volatility. By investing in Crediton, new landlords can benefit from the town's attractive rental yields and long-term house price growth potential.

As a property agent, I like to stay informed about these trends and communicate them to everyone interested in the Crediton property market. By highlighting the town's potential investment opportunities for landlords whilst addressing tenant concerns, we can foster a healthy and thriving rental market that benefits all parties involved.

by

by

posted by

posted by

posted by

posted by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link