I’ve always found the property market to be a barometer of economic health, reflecting the ebbs and ...

I’ve always found the property market to be a barometer of economic health, reflecting the ebbs and flows of financial stability and consumer confidence. As we navigate through the current economic landscape, marked by inflationary pressures and interest rate hikes, it’s crucial to understand how these factors are impacting the property market. In this article, I’ll delve into the latest data from Rightmove’s House Price Index, with a particular focus on the South West property market, which has shown resilience amidst these challenges.

The National Picture: A Market Feeling the Pinch

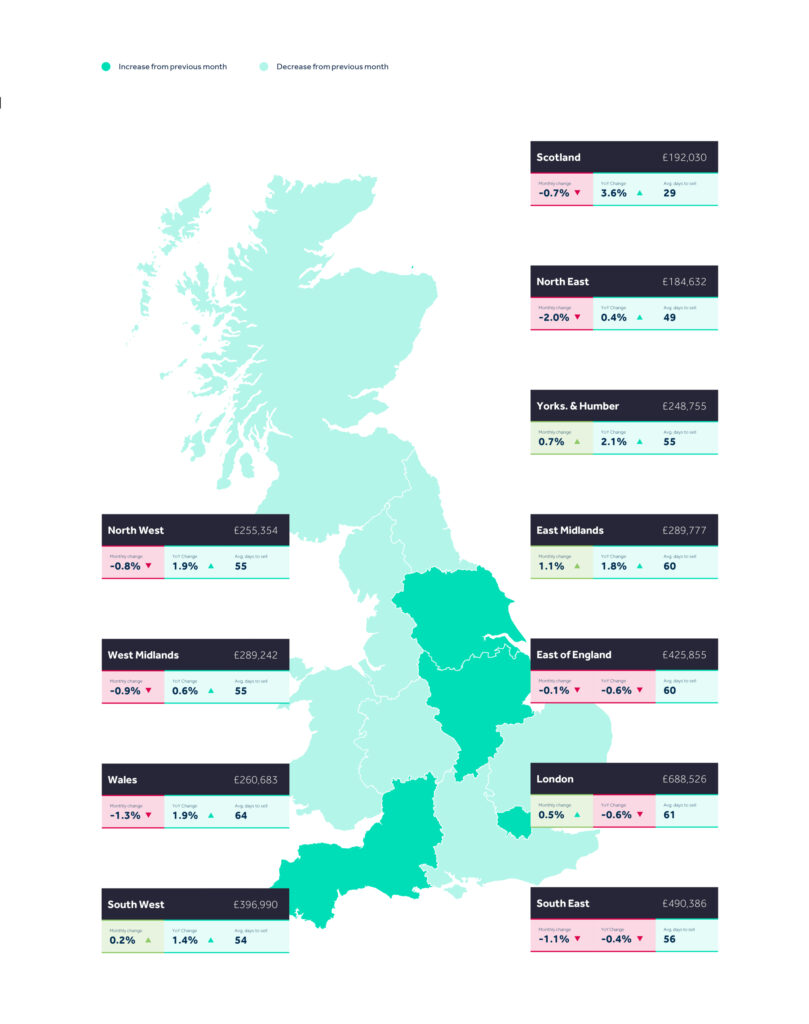

The latest House Price Index from Rightmove reveals that the average price of property coming to market has fallen by 0.2% this month. This slight dip is marginally below the 0% norm for this time of year, suggesting that new sellers are adjusting their price expectations in response to rising mortgage costs and increasing buyer affordability constraints.

The Bank of England’s recent Base Rate rises, aimed at combating stickier-than-expected inflation, are starting to have an impact. The number of sales agreed is now 12% behind 2019’s more normal market, contrasting with the surprisingly strong first five months of 2023. However, buyer demand remains resilient, being 3% higher than 2019, with agents reporting that right-priced homes are still attracting motivated buyers due to a shortage of property for sale compared to historic norms.

The Devon Difference: Bucking the Trend?

In contrast to the national picture, the South West property market, has shown a slight uptick. The monthly change in prices is up by 0.2%, and the year-on-year increase stands at 1.4%. The average days to sell a property is 54, indicating a relatively healthy market.

I think this resilience in the South West market can be attributed to several factors. The region’s appeal, with its stunning landscapes and quality of life, continues to attract buyers. Furthermore, the market has been buoyed by a shortage of quality property for sale, which has kept demand high and prices stable.

The Impact of Interest Rates

The average interest rate on a mortgage tracker for a five-year fixed, 85% Loan-To-Value mortgage is now 5.69%, up by 0.49% compared to last month. This increase has led some movers to pause their plans until there is more certainty that mortgage rates have stabilised.

However, in Devon, the impact of these interest rate rises may be somewhat mitigated. The region’s property market has a high proportion of buyers with larger deposits and lower mortgage requirements, which can help cushion the impact of rising interest rates.

The Importance of Pricing Right

The fact is, properties that need a reduction in asking price are more than 10% less likely to find a buyer than those that are priced right at the outset. This is particularly relevant in the current market conditions, where initial over-pricing can significantly reduce the chances of a sale.

In Devon, where the market is showing resilience, it’s even more critical for sellers to price their properties correctly. With motivated buyers still active in the market, a property priced in line with local market conditions is likely to attract interest and secure a sale.

Looking Ahead

While the property market faces challenges from inflation and higher mortgage rates, the Devon market’s resilience provides some optimism. The continuing demand from motivated buyers, coupled with a shortage of quality properties for sale, suggests that the market will remain robust.

However, sellers must be mindful of the changing economic landscape and price their properties correctly to attract buyers.

In conclusion, while the national property market is feeling the pinch from economic challenges, the South West market is bucking the trend. The coming months will undoubtedly bring more changes, but the resilience shown so far suggests that the local property market is well-placed to weather the storm.

What are your thoughts on the property market? How do you see it evolving in the coming months? I’d love to hear your views in the comments!

Stats and graphic source: Rightmove

posted by

posted by

posted by

posted by

posted by

posted by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link